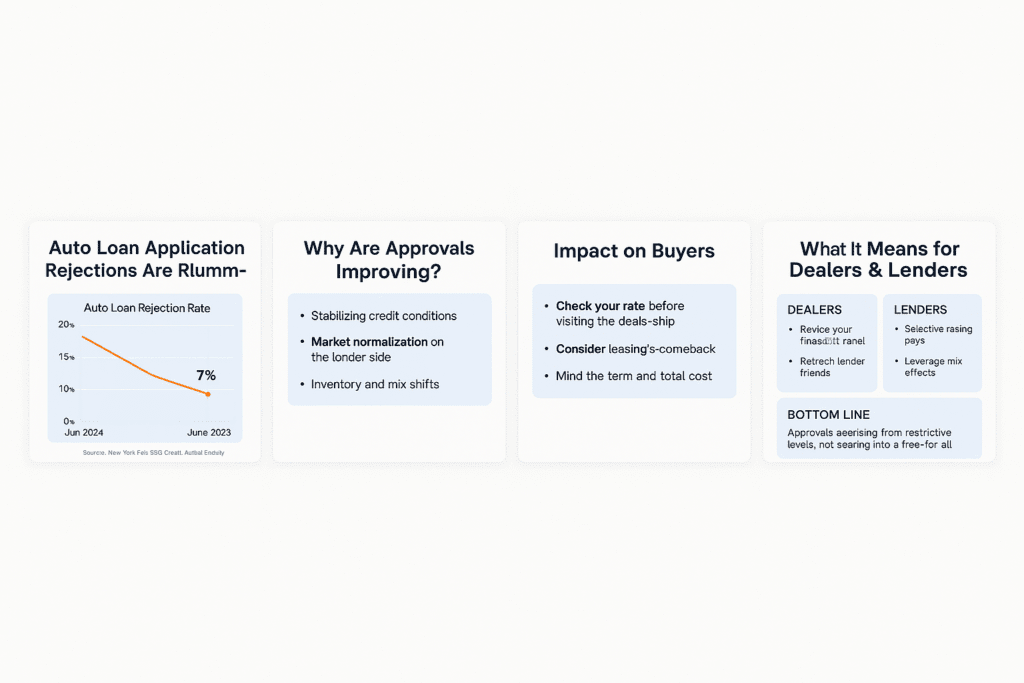

Rejection rates fell sharply in June 2025

Fresh data from the New York Fed’s Survey of Consumer Expectations (SCE) Credit Access Survey reports that overall credit application and rejection rates were broadly stable, with the notable exception of auto loans, where rejections “declined sharply” in June 2025. The same release also notes a drop in “discouraged borrowers”—people who needed credit but didn’t apply because they expected to be denied. Moreover, understanding the Auto Loan Rejection rate 2025 provides critical insights for potential borrowers and lenders alike. Source. (Federal Reserve Bank of New York)

Fresh data from the New York Fed’s Survey of Consumer Expectations (SCE) Credit Access Survey reports that overall credit application and rejection rates were broadly stable, with the notable exception of auto loans, where rejections “declined sharply” in June 2025. The same release also notes a drop in “discouraged borrowers”—people who needed credit but didn’t apply because they expected to be denied. Source. (Federal Reserve Bank of New York)

Independent coverage quantifies the shift: auto loan rejections fell to ~7% in June 2025, down from ~14% in February 2025—a halving in just four months. Reuters summary of the SCE results. (Reuters)

For consumers asking “Is it actually getting easier to finance a car?”, Forbes Advisor echoes the trend: “Auto loan rejection rates fell in Q2 2025.” Details. (Forbes)

Why approvals are improving (even with rates still elevated)

- Stabilizing credit conditions. The SCE shows improving perceived approval odds for auto loans, while actual rejections ticked down, suggesting lenders are modestly easing after a tight stretch. NY Fed SCE Credit Access. (Federal Reserve Bank of New York)

- Market normalization on the lender side. Experian’s Q1 2025 State of the Automotive Finance Market highlights a stabilizing landscape: banks regained share, 30-day delinquencies improved to 1.95%, and average rates edged down a touch versus 2024. Experian press release & report gateway. (Experian)

- Inventory and mix shifts. With new-vehicle share rising and leasing recovering, lenders have clearer collateral values and better portfolio mix options, enabling slightly more approvals at given risk bands. Experian Q1 2025 highlights. (Experian)

The important context (don’t ignore this)

- We’re bouncing from a tight peak. In late-2024 and early-2025, rejection risk and perceived denial odds hit multi-year highs. As recently as March 2025, consumers’ perceived probability of auto-loan rejection was at a series high. That has now improved into the summer. CBS summary of NY Fed SCE; March 2025 conditions. (CBS News)

- Delinquencies remain a watch item. Total auto balances continue to grow, and delinquency metrics are not back to pre-pandemic lows, even if some short-term measures improved in Q1. NY Fed topic page; debt & credit report; Experian Q1 2025 trends ; Experian. (Federal Reserve Bank of New York, Experian)

Bottom line: Approvals are rising from restrictive levels, not soaring into a free-for-all. Creditworthy shoppers will feel the improvement most.

What this means for car shoppers

- Check your rate before visiting the dealership. With approvals improving, rate shopping can pay off. Pre-approval from a bank or credit union can strengthen your negotiating stance. (See Experian’s consumer explainer on rates and payments in 2025.) Overview. (Experian)

- Consider leasing’s comeback. Leasing’s share rose to ~24.7% in Q1 2025, helping some buyers lower monthly outlay. Experian Q1 2025. (Experian)

- Mind the term and total cost. Slightly easier approvals don’t cancel the math: longer terms can inflate total interest paid. Use an amortization calculator and target the shortest term your budget can support.

What this means for dealers

- Revive your finance funnel. With discouragement easing and approvals improving, tighten your lead response and pre-qualification workflows to capture buyers who sat out earlier this year. The SCE shows the share of “discouraged borrowers” falling from 8.5% in February to 7.2% in June—real shoppers are back. NY Fed SCE. (Federal Reserve Bank of New York)

- Refresh lender menus. Banks gained market share in Q1 2025; captives still lead new-car financing. Offer a diversified lender lineup (banks, credit unions, captives) to maximize approval coverage per credit tier. Experian Q1 2025. (Experian)

- Optimize payments—not just price. With average monthly payments still high, structure deals around affordable payment-to-income targets and present leasing transparently where it fits.

What this means for lenders

- Selective easing pays. The SCE points to improved access without a spike in overall risk appetite. Pair granular scorecard adjustments with refreshed collateral valuation assumptions (especially on used) to capture profitable demand while monitoring delinquency cohorts. NY Fed; Experian Q1 2025 ; Experian. (Federal Reserve Bank of New York, Experian)

- Leverage mix effects. Leasing’s rebound and new-vehicle supply normalization reduce certain residual risks; align approval cutoffs accordingly.

Should you “buy before prices rise” on tariff headlines?

Spring headlines warned buyers to rush before potential tariff-driven price increases, yet financing frictions were a major roadblock at the time. Conditions have since improved, but buyers should avoid panic purchases and instead compare multiple offers and validate approval terms first. Context from recent coverage ; MarketWatch guide. (The Wall Street Journal, MarketWatch)

Sources & further reading

- New York Fed – SCE Credit Access Survey (June 2025): auto-loan rejections “declined sharply”; discouraged borrowers down. (Federal Reserve Bank of New York)

- Reuters: NY Fed survey finds easier access to auto loans… (quantifies ≈14% → 7% from Feb→Jun 2025). (Reuters)

- Forbes Advisor: Auto loan rejection rates fell in Q2 2025. (Forbes)

- Experian – State of the Automotive Finance Market, Q1 2025: market share shifts, 30-day delinquency improved, leasing ticked up. (Experian)

- NY Fed – Credit Cards & Auto Loans topic page: balances and delinquency context. (Federal Reserve Bank of New York)