The world of automobiles can feel vast and complex, whether you’re a seasoned car enthusiast or a first-time buyer. At ANKSO, my goal is to demystify the industry using my decades of experience in finance and dealerships.

This post tackles seven of the most frequently asked questions I encounter, providing clear, concise answers to help you navigate your automotive journey with confidence.

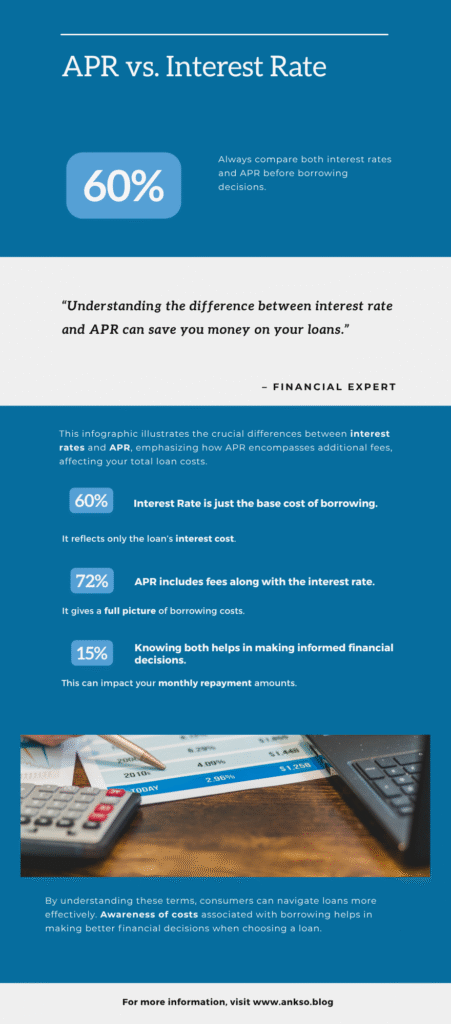

FAQ #1: What’s the difference between APR and interest rate when financing a car?

This is a crucial question for anyone taking out an auto loan.

Answer: While often used interchangeably, APR (Annual Percentage Rate) and the interest rate are not exactly the same.

- Interest Rate: This is the cost you pay each year to borrow the money, expressed as a percentage of the loan amount.

- APR: This is a broader measure of the cost of borrowing money. It includes the interest rate plus other fees associated with the loan, such as origination fees or discount points, expressed as an annual rate.

Key Takeaway: Always focus on the APR when comparing loan offers, as it gives you a more complete picture of the true cost of borrowing. A seemingly lower interest rate might be offset by higher fees, resulting in a higher overall APR.

FAQ #2: How much should I put down on a car?

The ideal down payment depends on several factors, but there are some general guidelines.

Answer: There’s no one-size-fits-all answer, but aiming for at least 10-20% of the vehicle’s purchase price is generally recommended.

- Benefits of a Larger Down Payment:

- Lower monthly payments.

- Less interest paid over the life of the loan.

- Increased equity in your vehicle sooner.

- Better chances of loan approval and potentially lower APRs.

- Considerations: Your personal financial situation, interest rates, and loan terms should also be factored in. Sometimes, keeping a bit more cash on hand for emergencies might be a priority.

Insider Tip: As a former Finance Manager, I saw that buyers with larger down payments often qualified for better rates because they represented less risk to the lender.

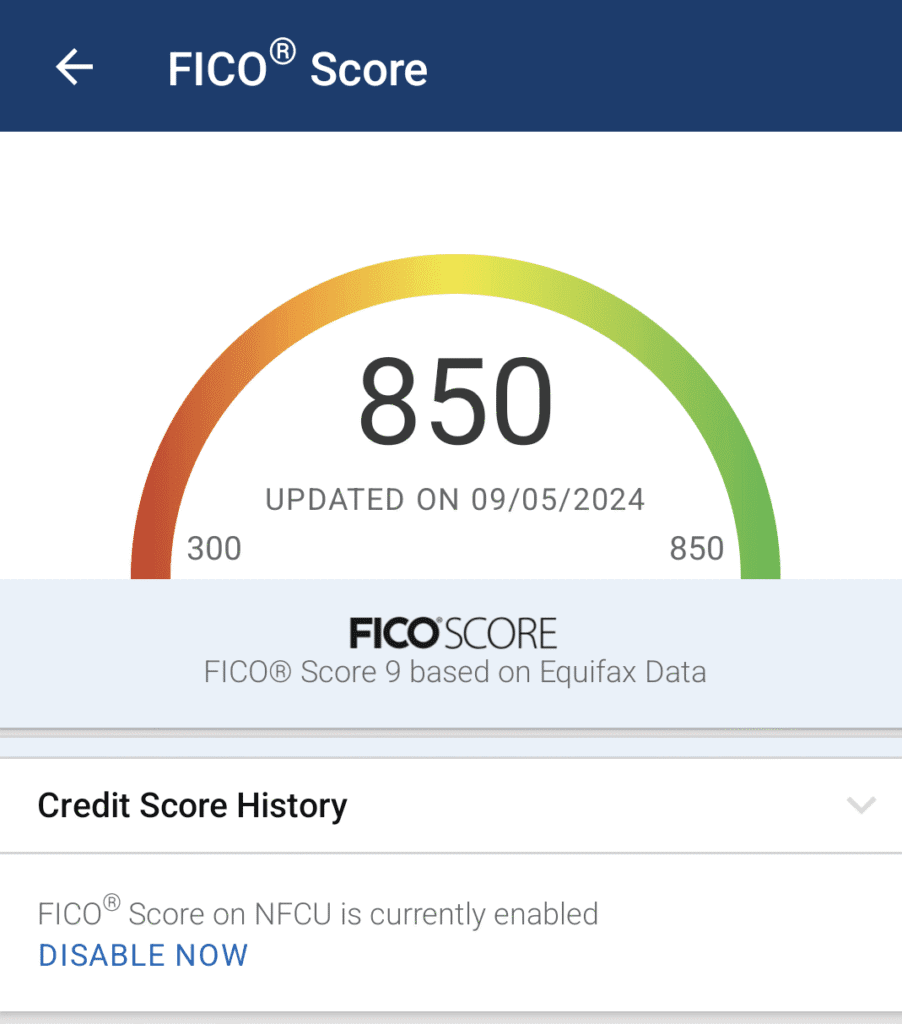

FAQ #3: What credit score do I need to get a good auto loan rate?

Your credit score plays a significant role in the interest rate you’ll qualify for.

Answer: While it’s possible to get a car loan with a lower score, a good to excellent credit score (typically 670 and above) will generally qualify you for the most favorable interest rates.

- Credit Score Ranges (FICO):

- Excellent: 750+

- Good: 670-749

- Fair: 580-669

- Poor: Below 580

- Impact of Score: The difference in APR between excellent and poor credit can be substantial, costing you thousands of dollars over the loan term.

Actionable Tip: Before you start car shopping, check your credit report and take steps to improve your score if needed.

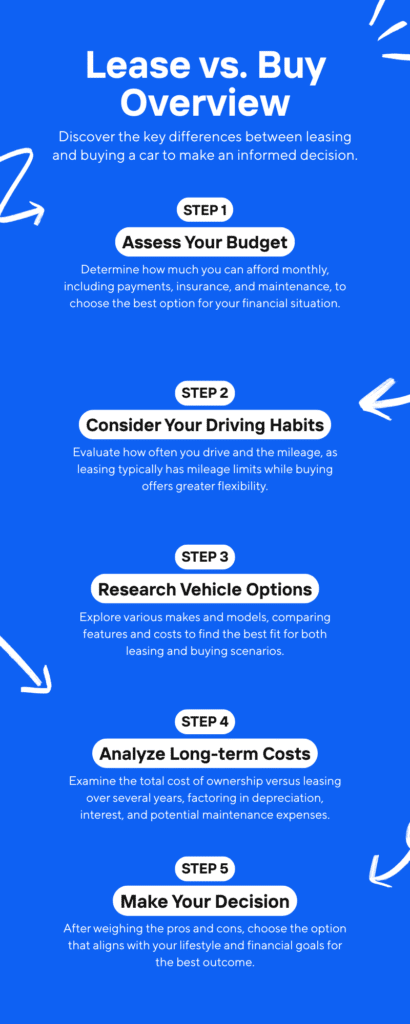

FAQ #4: Is it better to lease or buy a car?

This is a personal decision with different financial implications.

Answer: Neither leasing nor buying is universally “better”; it depends on your individual needs and circumstances.

- Leasing: Typically involves lower monthly payments and the ability to drive a new car more often. You don’t own the vehicle at the end of the lease.

- Buying: Leads to ownership once the loan is paid off, allowing you to build equity. You can also drive unlimited miles and customize the vehicle.

Considerations: Mileage restrictions, wear-and-tear charges, and the long-term cost of ownership are key factors to weigh.

FAQ #5: How do I negotiate the price of a new car?

Negotiation can seem intimidating, but with the right strategies, you can save money.

Answer: Effective negotiation involves research, confidence, and a willingness to walk away.

- Do Your Homework: Know the market value (MSRP vs. invoice price) and any available incentives.

- Shop Around: Get quotes from multiple dealerships.

- Focus on the Out-the-Door Price: This includes all fees and taxes.

- Be Polite but Firm: Don’t be afraid to make a reasonable counteroffer.

- Separate Negotiations: Negotiate the vehicle price before discussing financing or trade-in.

Insider Tip: Dealerships often have more flexibility on vehicles that have been on the lot for a while.

FAQ #6: What should I look for when inspecting a used car?

A thorough inspection is crucial to avoid costly surprises.

Answer: Before buying a used car, pay close attention to the following:

- Exterior: Check for rust, dents, mismatched paint.

- Interior: Look for excessive wear and tear, test all features.

- Under the Hood: Inspect fluid levels, look for leaks or corrosion.

- Test Drive: Pay attention to engine noise, handling, and braking.

- Vehicle History Report: Obtain a report (like Carfax or AutoCheck) to check for accidents or title issues.

- Pre-Purchase Inspection (PPI): Have a trusted mechanic inspect the car before you buy.

FAQ #7: How often should I have my car serviced?

Regular maintenance is key to extending your vehicle’s lifespan and preventing costly repairs.

Answer: Follow your owner’s manual for specific service intervals. However, some general guidelines include:

- Oil Change: Typically every 5,000-7,500 miles (or as recommended).

- Tire Rotation: Every 6,000-8,000 miles.

- Fluid Checks: Regularly monitor coolant, brake fluid, power steering fluid, etc.

- Major Services: Follow the schedule for spark plugs, timing belts, etc.

Proactive Tip: Regular maintenance not only keeps your car running smoothly but can also help maintain its resale value.

Conclusion: Your Automotive Questions, Answered

Navigating the automotive world doesn’t have to be a source of stress. By understanding these frequently asked questions, you’re already more informed and empowered to make smart decisions.

At ANKSO, I’m dedicated to providing you with the knowledge you need to drive with confidence, both on the road and with your finances.

Have more questions? Head over to our Contact page – I’m always happy to help!